Excise Taxes on Wireless Services: A Growing Burden for Small Businesses

The landscape of excise taxes and fees on wireless services continues to evolve, with a significant impact on small business owners and entrepreneurs. As of 2025, consumers' tax burden on wireless services has now soared to an unprecedented 27.60 percent of the average bill. This statistic is particularly concerning for small business owners who rely heavily on mobile connectivity for operations, marketing, and communication with clients.

Record-High Wireless Taxes: What Does It Mean?

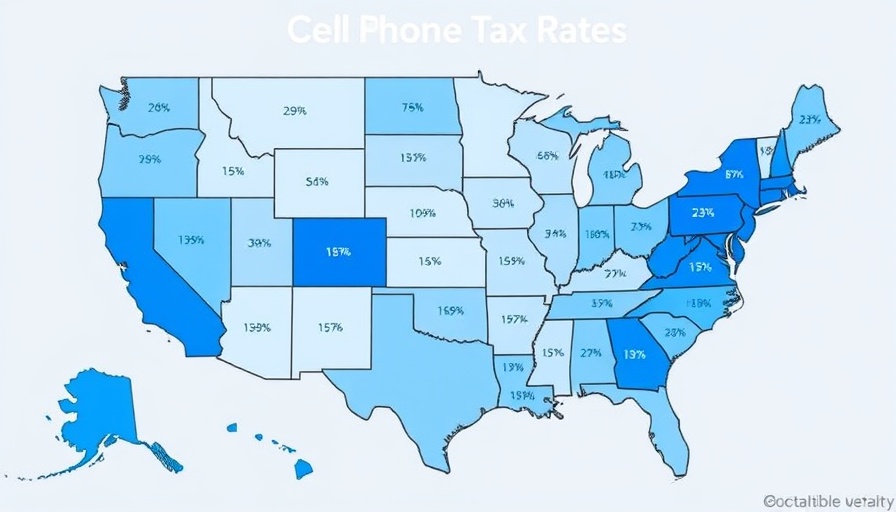

A typical American household, with four phones on a family share plan, incurs about $330 annually in taxes and fees. For small business owners, this translates into higher operational costs, which can be challenging to absorb. Illinois leads the nation with the highest wireless taxes at 38.32 percent, emphasizing the pressing need for fiscal reform within the state. Such burdens make it arduous for small businesses to maintain competitive service pricing while striving to deliver quality service to their clientele.

The Rise in State Taxes: A Case Study of Louisiana

Among the states, Louisiana exhibited the largest tax increase in 2025, jumping from 24.70 percent to 31.90 percent due to newly passed legislation. This reform package raised the sales tax on wireless services and reflects a wider trend where states are increasingly relying on wireless taxation to bolster revenues. Small businesses in Louisiana now face the dual burden of providing competitive telecommunication services while grappling with increased tax obligations. This serves as a case study on how local policies can inadvertently stifle economic growth.

Implications of the Federal Universal Service Fund

At the federal level, the Federal Universal Service Fund (FUSF) charge has also experienced an uptick, from 12.76 percent to 13.36 percent. This increment is troublesome, particularly as nearly 83 percent of low-income adults utilize wireless services exclusively. As wireless tax burdens disproportionately affect low-income families, small business owners may find it increasingly difficult to justify rising costs to their customer base. Additionally, the Permanent Internet Tax Freedom Act restricts states from imposing taxes on wireless internet access, which could have relieved some financial pressures.

Understanding the Economic Pressures on Consumers

The average price for wireless services has dropped by 29 percent since 2012, declining from $47.00 per line to $33.36 per line. However, while prices struggle to stay competitive, constantly rising taxes and surcharges make it exceptionally challenging for businesses to find a balance. The easing in service costs, unfortunately, only partially mitigates the pain of escalating taxes. For small business owners, this means that every cost saved through competitive pricing is likely offset by the tax increases, which ultimately leads to tighter profit margins.

The Regressive Nature of Wireless Taxes

Regrettably, these taxes are notably regressive and contribute significantly to financial challenges among low-income families and small businesses alike. With a staggering 78 percent of all adults relying on wireless services, the unequal distribution of these tax burdens places additional pressure on those least equipped to absorb it. Small business owners should recognize this dynamic and advocate for more equitable tax policies that support rather than hinder their growth.

Next Steps: Adjusting Strategies in an Ever-Changing Landscape

With this increasing tax burden, which clearly highlights the urgent need for reform, small business owners are advised to adapt their strategies. Engaging with local and state policymakers to advocate for fair taxation within the wireless sector is pivotal. It’s also vital to explore potential rebates and credits that could help mitigate these surcharges. Collaboration with industry peers to share best practices and strategies for managing costs associated with these taxes can foster resilience within the small business community.

As we move deeper into the future, remaining informed about evolving tax landscapes and advocating for policy change will be essential for small business owners. Engage actively in economic discussions and take steps to ensure that your voice is heard, leveraging these insights to protect and enhance your operations.

Add Row

Add Row  Add

Add

Write A Comment