For years, Roth IRAs have been praised as the “tax-free retirement jackpot.” Pay taxes now, and enjoy tax-free withdrawals later—that’s the promise. But thanks to the latest tax law changes, this popular strategy may not be as beneficial as many believe.

In fact, if you live in Grand Rapids or anywhere in West Michigan, it’s especially important to know how these rules affect you. Local taxes, state-level planning, and the new federal changes mean that blindly following old Roth IRA advice could cost you tens of thousands of dollars.

That’s why now—before you make a big financial move—is the right time to step back and review whether a Roth IRA still makes sense for your retirement strategy.

The Traditional Roth Promise (and Why It’s Cracking)

The pitch sounds great:

Contributions are made with after-tax dollars

Growth and qualified withdrawals are tax-free

No required minimum distributions during your lifetime

A potential estate planning tool for heirs

But here’s the problem: the newest tax laws have shifted the math. What worked a few years ago doesn’t automatically work today. For many West Michigan savers, what used to be a smart play is now a costly mistake.

he New Tax Law Changes the Roth Equation

1. Forced Roth Catch-Up Contributions for High Earners

If you make over ~$145,000, new rules require all catch-up contributions (age 50+) to be Roth. Translation? No upfront deduction, and you’re forced to pay taxes sooner.

2. Conversions Can Trigger Hidden Tax Costs

Roth conversions don’t just mean paying taxes on the amount converted. They can also:

Knock you out of deductions like SALT or QBI

Increase your Medicare premiums (IRMAA surcharges)

Trigger the Net Investment Income Tax if you cross thresholds

3. “Permanent” Tax Rates Shift Conversion Timing

Lower federal tax rates have been extended through 2028. That means rushing into a big Roth conversion now could mean overpaying in taxes when patience may pay off.

4. The Senior Deduction Penalty

Michigan retirees may qualify for state and federal deductions. But a Roth conversion can push your income too high, wiping out those tax breaks.

5. Roth Income Limits Remain

Contribution phase-outs still limit Roth eligibility for higher earners. Backdoor Roth strategies are possible but risky, especially if you already have large pre-tax accounts.

6. Inherited Roth's Must Be Emptied in 10 Years

Your heirs can no longer stretch distributions across their lifetimes. That means less long-term tax-free compounding.

7. Policy Risk Isn’t Going Away

Roth's are only “tax-free” as long as Congress allows them to be. Tax laws change—and Roth IRAs aren’t immune.

The Real-World Downsides of Roth's

Unexpected Tax Spikes: A big conversion could push you into higher brackets.

Lost Deductions: Conversions can wipe out credits and tax breaks you count on.

Healthcare Surprises: Higher income can raise your Medicare premiums.

Reduced Flexibility: Once you convert, there’s no going back.

-

Estate Planning Limitations: Beneficiaries face forced drawdowns in 10 years.

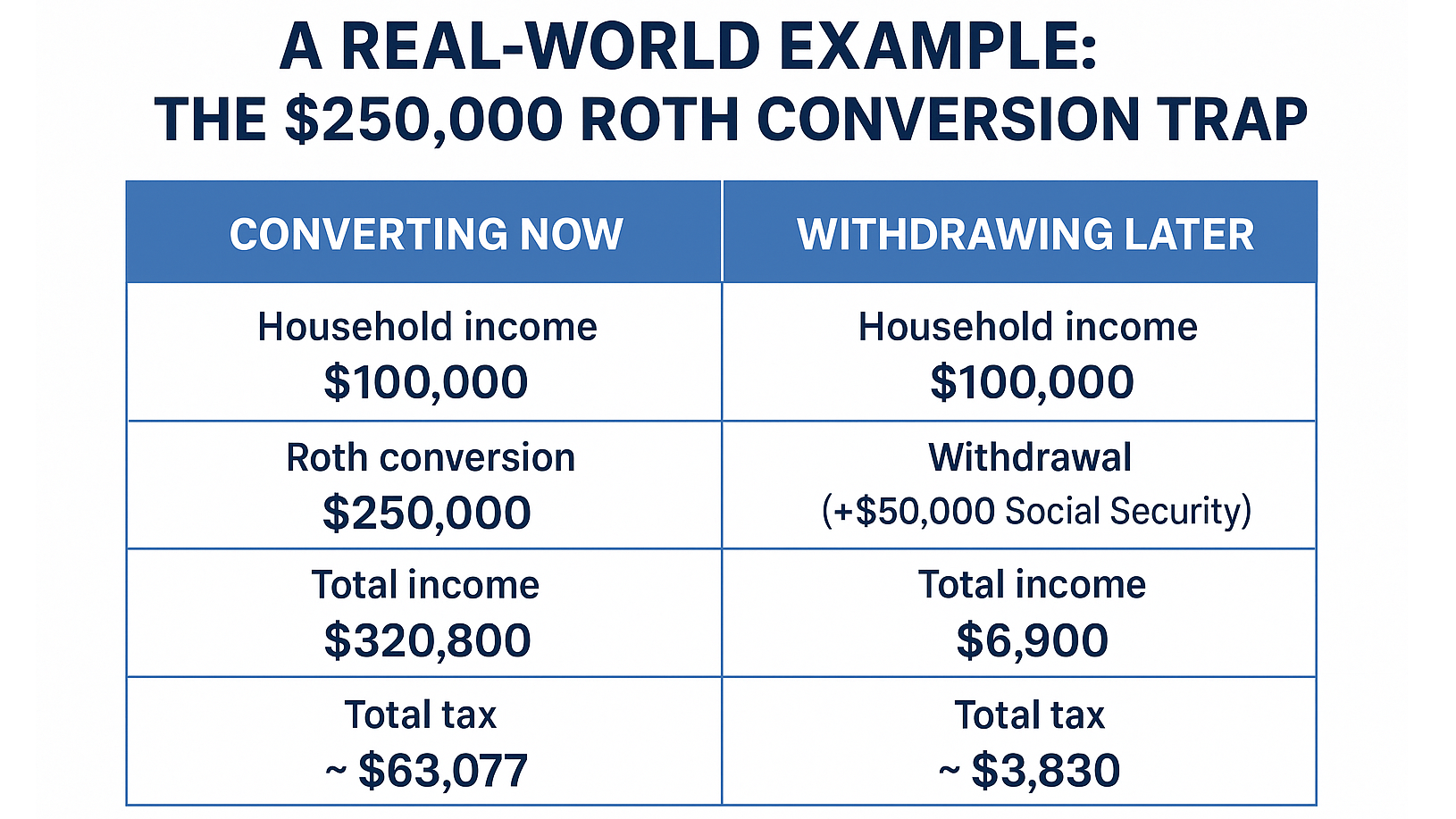

A Real-World Example: The $250,000 Roth Conversion Trap

Let’s walk through how this really looks under the new 2025 tax rules for a couple in Grand Rapids, MI filing jointly.

Scenario 1: Converting $250,000 While Still Working

Household income: $100,000

Roth conversion: $250,000

Total income = $350,000

Subtract 2025 standard deduction (married filing jointly): $29,200

Taxable income = $320,800

Total estimated tax due: ≈ $63,077

That’s over $63,000 in taxes owed immediately—before the couple even retires.

Scenario 2: Waiting Until Retirement at Age 65

Instead, they wait until retirement and withdraw $25,000 a year while collecting $50,000 in Social Security. Based on current IRS rules, only about $36,100 of their total income would be taxable.

Total income: $75,000

Taxable portion: $36,100

Subtract 2025 standard deduction: $29,200

Taxable income = $6,900

Total estimated tax due: ≈ $383 per year

Over 10 years: ≈ $3,830 total tax paid

That’s a difference of nearly $60,000 in taxes saved — simply by waiting to withdraw instead of converting early.

Disclaimer: The example above is for illustration purposes only and uses 2025 federal tax assumptions. Actual tax results will vary based on your income, deductions, filing status, and future changes in law. This is not tax or investment advice. Always consult a qualified financial advisor or tax professional before making decisions about Roth conversions.

When a Roth Still Makes Sense

Roth IRAs aren’t always bad. They may be useful if:

You expect to be in a much higher tax bracket later

You have decades ahead for compounding

You’re in a temporary low-income year

You want a mix of pre-tax and after-tax retirement accounts for flexibility

But for many in Grand Rapids and across West Michigan, the “Roth always wins” mindset is outdated and potentially dangerous.

FAQs About Roth IRAs and the New Tax Law

Q1: Are Roth IRAs still worth it after 2025?

A: Only in specific cases, such as low-income years or long-term growth strategies. Most taxpayers need careful modeling.

Q2: Can a Roth conversion increase my Medicare premiums?

A: Yes. Higher AGI from conversions can trigger IRMAA surcharges.

Q3: What is the 10-year rule for inherited Roth's?

A: Non-spouse beneficiaries must deplete the account within 10 years, limiting long-term tax-free growth.

Q4: Are backdoor Roth contributions safe?

A: They can be effective but come with complexity and risk due to pro-rata rules.

Q5: Will forced catch-up contributions affect me?

A: If your income exceeds ~$145,000 and you’re over 50, catch-up contributions must go into a Roth, removing deduction benefits.

Q6: How do new tax rates affect Roth conversions?

A: Extended lower rates through 2028 reduce urgency for large conversions, and improper timing can create higher tax liabilities.

Q7: How can I avoid Roth tax traps?

A: Personalized analysis of income, deductions, and state taxes is essential. A free Roth audit can help you plan wisely.

Take Action Now

Roth IRAs aren’t the guaranteed win they used to be. The new tax law changed the rules of the game. If you’re in West Michigan—especially Grand Rapids—protect your retirement by getting a personalized review.

Add Row

Add Row  Add

Add

Write A Comment